Finansal Kiralama, Faktoring ve Finansman Şirketleri Birliği ve Bağlı Ortaklıkları

Notes to the consolidated financial statements

as of December 31, 2016

(All amounts expressed in Turkish Lira (“TL”))

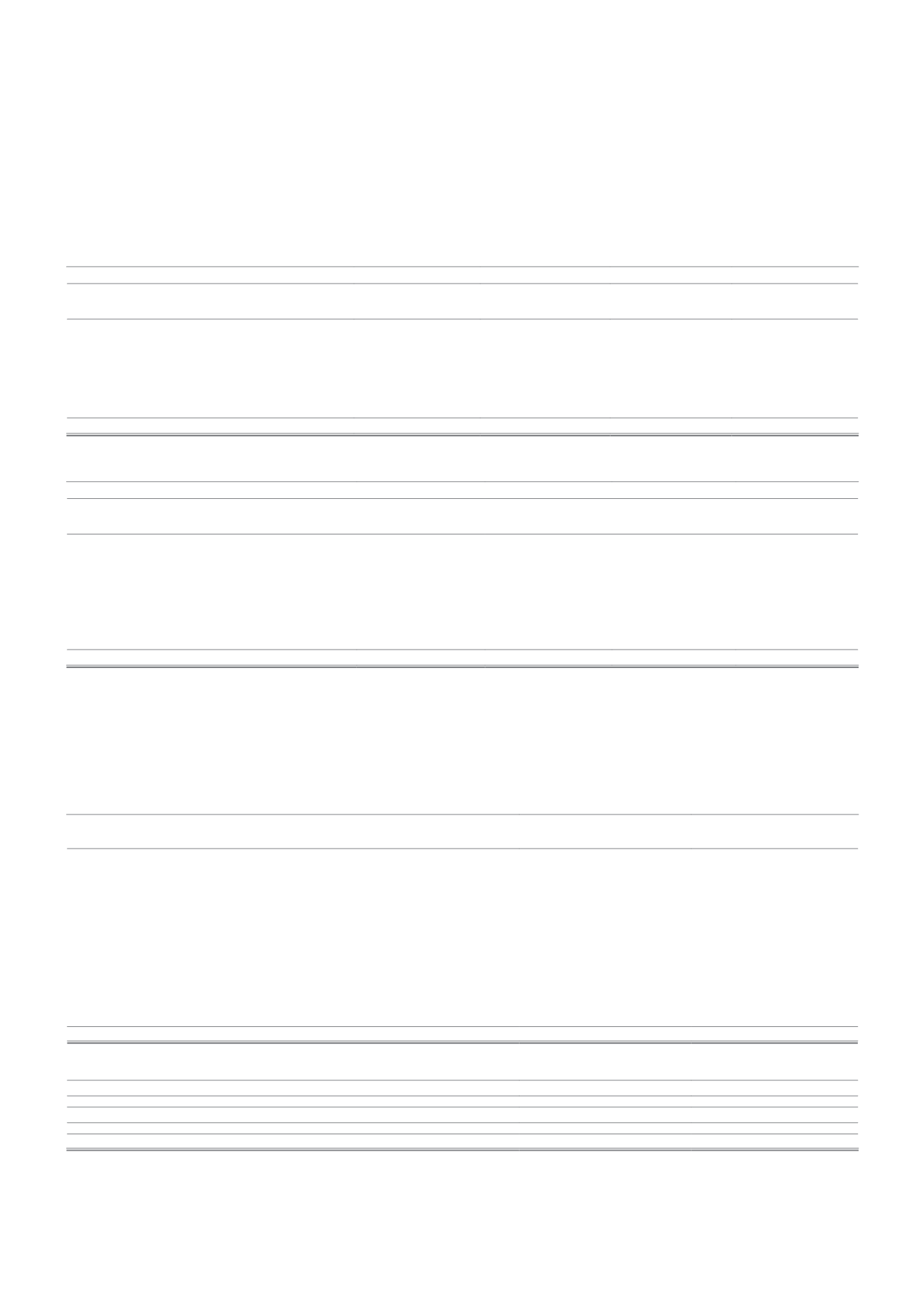

Deferred tax liability

Temporary differences

Deferred tax asset/liability

December 31,

2016

December 31,

2015

December 31,

2016

December 31,

2015

Depreciation correction of tangible and

intangible assets

(86.807)

(71.235)

(17.361)

(14.247)

Provisions for severance pay

16.745

10.336

3.348

2.067

Unused vocation liability

1.965

-

393

Deferred tax liability

(68.097)

(60.899)

(13.620)

(12.180)

Deferred tax assets / liabilities, net

Temporary differences

Deferred tax asset/liability

December 31,

2016

December 31,

2015

December 31,

2016

December 31,

2015

Depreciation correction of tangible and

intangible assets

(91.114)

(72.419)

(18.223)

(14.484)

Provisions for severance pay

35.481

18.303

7.096

3.661

Provisions for accumulated leave

(27.573)

2.122

5.515

424

Doubtful receivables

-

18.605

-

3.721

Deferred tax assets / liabilities, net

(28.060)

(33.389)

(5.612)

(6.678)

13. Other current liabilities

Other current liabilities consists of taxes and funds payable TL 73.280, reverse charge value added tax TL 186, other liabilities TL 6.984.

(December 31, 2015: Other current liabilities consists of taxes and funds payable TL 124.597, reverse charge value added tax TL 169,

expense accruals TL 12.835, other liabilities TL 2.660.)

14. Sales and cost of sales

January 1, 2016 –

December 31, 2016

January 1, 2015 –

December 31, 2015

Domestic registration fee income

3.748.950

5.393.000

Association participation share costs

4.125.342

4.313.018

“MFKS” income

(*)

3.000.300

2.940.395

Education expenses

539.580

490.590

Factoring sector participation share cost

775.069

1.031.472

Financial leasing participations share cost

453.667

501.667

Financing company participations share costs

485.334

329.333

Foreign registration fee income

39.000

45.500

Financing company entrance fees

80.000

40.000

Other revenue

-

6.068

Total

13.247.242

15.091.043

Sales returns (-)

-

-

Net Sales

13.247.242

15.091.043

Cost of sales (-)

(3.529.505)

(3.154.583)

Gross profit

9.717.737

11.936.460

(*)

“MFKS” revenues, as stated in Article 43 as Central Invoice Recording, of the Financial Leasing, Factoring and Finance Companies Law no 6361; Factoring companies and banks, invoice

information consists of including information regarding the claims they are taken over, to be obtained for the system to consolidation centralized invoice record infrastructure cost of

participation and centralized invoice record system service fee.

96

Annual Report 2016

The Association of Financial Institutions